When considering gold as a potential investment, two primary options often emerge: the Gold IRA and physical gold. Each approach offers distinct benefits, making the choice a nuanced one. A Gold IRA allows you to invest to an individual retirement account specifically structured for gold and other precious metals. Physical gold, on the other hand, involves acquiring tangible coins.

- Elements such as your investment goals, risk tolerance, and availability needs ought to be carefully considered when making your choice.

- A Gold IRA extends potential tax benefits, while physical gold can offer a sense of ownership

Ultimately, the best choice for you depends on your specific circumstances. Consulting a qualified financial advisor can provide helpful guidance in navigating this selection.

Gold IRA vs. 401(k):

Choosing the right retirement savings vehicle can be daunting, especially with options like Gold IRAs and 401(k)s available. A traditional Gold IRA offers diversification through precious metals, potentially shielding your portfolio against inflation and market volatility. Conversely, a 401(k) is a employer-sponsored offering potential for significant employer contributions and compound growth through investments in stocks and bonds. It's essential to thoroughly assess your risk tolerance, financial goals, and individual circumstances to determine the best approach for maximizing your retirement savings.

- Aspects to weigh include: desired return on investment, inflation protection needs, and tax implications.

- Consult with a qualified professional to create a personalized plan that aligns with your specific goals.

Considering the Investment: The Pros and Cons of a Gold IRA

A Gold Individual Retirement Account (IRA) presents a unique investment opportunity for individuals seeking to allocate their retirement portfolio. Although gold has historically been seen as a secure asset against market volatility, investing in a Gold IRA comes with both pros and disadvantages.

- A primary pro of a Gold IRA is its potential for retention of wealth during times of economic instability.

- Physical assets' inherent value can buffer your portfolio from the downswings associated with traditional investments.

- On the other hand, Gold IRAs typically have higher costs compared to conventional IRAs.

- Furthermore, gold prices can be fluctuating, meaning your investment may not always increase in value.

Before investing in a Gold IRA, it is important to thoroughly analyze the challenges and rewards involved. Meeting a financial advisor can provide valuable guidance to help you make an informed choice.

Investing in Gold IRAs: Selecting the Optimal Provider for Your Requirements

Embarking on a journey to build a Gold IRA involves meticulous research and the selection of a reputable provider. With numerous options available, it's crucial to discover a company that suits your specific needs and aspirations. Consider factors such as expenses, customer assistance, holding management practices, and comprehensive standing. By carefully evaluating potential providers, you can enhance your chances of a successful Gold IRA venture.

- Review the benefits and weaknesses of various providers.

- Request detailed information regarding their products, costs, and regulations.

- Reach out with existing clients to gather opinions about their experiences.

Accessing Tax Advantages by means of a Gold IRA

A Gold IRA presents an enticing opportunity for savvy investors seeking to mitigate their tax burden. By augmenting your portfolio with physical gold, you Gold IRA fees can potentially achieve significant financial advantages.

Gold IRA contributions may be fully tax-advantaged, depending on your individual circumstances and the type of plan you choose. Moreover, profits from a Gold IRA are frequently postponed until retirement. This means that you avoid paying taxes on your gold's appreciation until distribution happens.

Thus, a Gold IRA can be a potent tool for expanding your wealth while leveraging tax benefits.

Should You Consider a Gold IRA?

Investing in precious metals like gold has long been regarded as a sound way to diversify your portfolio and potentially safeguard against inflation. But with the rise in popularity of Gold IRAs, many investors are wondering whether this type of retirement account is right for them. A Gold IRA allows you to invest a portion of your retirement savings into physical gold, silver, platinum, or palladium. These assets can offer security during periods of economic uncertainty and may provide a valuable hedge against market volatility.

Before making a decision, it's essential to meticulously consider the pros and cons of a Gold IRA and establish if it aligns with your overall investment strategy and retirement goals.

- Considerations to Consider:

- Fees: Gold IRAs typically involve higher fees compared to traditional IRAs.

- Availability: Accessing your gold investment may be more complex than with other types of investments.

- Asset Allocation: Gold should be a part of a well-diversified portfolio, not your entire investment strategy.

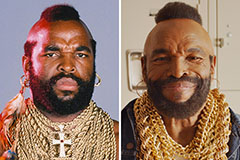

Mr. T Then & Now!

Mr. T Then & Now! Ralph Macchio Then & Now!

Ralph Macchio Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Teri Hatcher Then & Now!

Teri Hatcher Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now!